TPD Insurance: Any vs Own Occupation

As the name suggests, Total and Permanent Disability or TPD Insurance pays a lump sum benefit when the life insured has a disability that will prevent him, or her, from working every again.

While, in theory, this may sound fairly straight forward, in practice diagnosing someone as totally and permanently disabled is often a subjective exercise where opinions differ.

“When I use a word, it means just what I choose it to mean — neither more nor less” – Humpty Dumpty, Through the Looking Glass by Lewis Carroll

A quick online search brings up the following definition for disability

A physical or mental condition that limits a person’s movements, senses, or activities

By this definition, just about everyone over the age of 40 probably suffers some form of disability.

A search of the words “total disability” return the following

Impairment of mental or physical faculties that completely prevents a person from functioning normally.

Unfortunately they don’t go on to define normally.

Can I function normally if I can only sit for 30 minutes at a time without needing to stretch to avoid back pain?

What if I walk with a permanent limp and am colour blind?

The above may sound pedantic to the average person. After all, applying a label does nothing to change a person’s situation. Or does it? Indeed when a financial benefit (i.e. insurance payout) is at stake, applying the label of Totally and Permanently disabled could make a million dollar difference to someone’s life.

Defining Occupation

In order to make the determination of Total and Permanent Disability more objective, it is necessary to agree on what Total and Permanent Disability means.

Since TPD Insurance is generally concerned with protecting against long term loss of income, most life insurance policies use one of the following definitions:

Own Occupation

For a person to receive a TPD Insurance benefit under the Own Occupation definition, there must be sufficient evidence that the person covered by the policy:

is incapacitated to such an extent as to render the Life Insured unlikely ever to be able to work in their Own Occupation;

Any Occupation

For a person to receive a TPD Insurance benefit under the Any Occupation definition, there must be sufficient evidence that the person covered by the policy:

is incapacitated to such an extent as to render the Life Insured unlikely ever to be able to work in any occupation for which they are reasonably suited by training, education or experience which would pay remuneration at a rate greater than 25% of the Life Insured’s earnings during their last 12 months of work;

Important note

While the definitions are similar, every life insurance company uses slightly different wordings for Any and Own Occupation. The above definitions were taken from one particular life insurance company’s Product Disclosure Statement (PDS). Be sure to consult the PDS for any life insurance product you are considering prior to application.

Which Occupation Should You Choose?

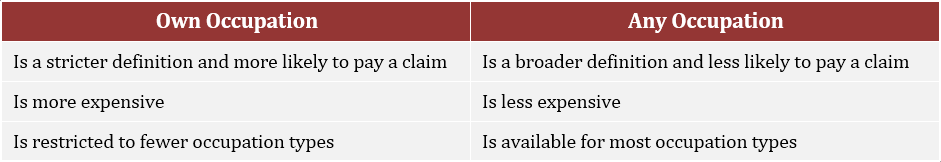

As with most choices in life, each option has Pros and Cons. The following table highlights the main differences between Any Occupation and Own Occupation definitions.

Assuming you are eligible for both definitions, therefore, your choice comes down to a tradeoff between cost and quality of cover. Own Occupation costs more, but will cover you under more circumstances. Any Occupation is cheaper, but may make it more difficult to claim.

One thing you may wish to consider is obtaining some TPD Insurance with an Own Occupation definition and some with an Any Occupation definition.

How Can We Help?

Our life insurance specialists are experts at constructing creative personalised life insurance solutions that provide the maximum amount of cover at the most affordable price.

If you’ve found this article helpful, contact us today to see how else we may be able to help.